|

|

Some years ago I asked myself the question "Where does the money come from?". This took me on a journey into understanding the concept of money, currency and eventually economics. What I found was absolutely mind blowing in its implications for humanity But let’s start at the beginning - What is money?The answer you get to this question depends upon where you look or who you ask because like so many powerful words in our language it comes with multiple meanings but I want to take you back to the very beginning of when the term first entered the language of humans If you consult an etymology of the word you will find something like this: : money (n.) the term possibly derives from many possible sources-

If you explore its definition in an economics dictionary you’ll find something like this

The emphasis is on "anything," because any item or asset can serve as 'money' so long as it is generally accepted in exchange by a recipient. And this is the most useful concept of the term in understanding the place that money plays in the creation of an economy. To do this though we need to travel back at least tens of thousands of years and most possibly over 100,000 years if we wished to be present at the birth of money into a human social environment. Just prior to the birth of money we would have seen humans living at a time where they would have been remarkably, if not exclusively, self-reliant in meeting all their needs. For humans, food, water, shelter clothing and tools would have been exclusively and comprehensively derived within a single family unit without external input . The birth of money occurred when one human exchanged a commodity with another human with the consequence being of benefit for both parties. Historians refer to this as the Barter Era. We don’t know exactly when the Barter Era mutated into the Currency Era but the oldest currency so far uncovered by archaeologists dates back to approximately 3000 years ago, so probably add another couple of thousand years on to that and I think it would be reasonably safe to say the mutation occurred about 5000 years ago. So why did we mutate from the Barter system to the Currency system as our preferred form of use for money? Well, it’s not hard to imagine that lumping around 100 chickens under your arm in order to exchange them for some other daily need was not a very satisfactory practice. For one thing it would have a high degree of physical difficulty, secondly it was not an effective exchange mechanism because it was only applicable when you encountered another individual who was desirous of chicken and thirdly and more significant than either of the other two factors, they was perishable. So the trick was to find a medium of exchange that was

Initially it is easily to imagine that this was filled by precious objects and metals and it’s easy to imagine that as groups of humans grew into larger societies under the influence and control of powerful individuals such as Kings that the next mutation of the barter system would occur. - The production of coins of the Realm (Currency) CurrencyThis currency (money) not only introduced the concept of a standardised value thus almost universally applicable to barter transactions (i.e. one coins for a goat; three coins for a donkey; five coins for a horse and seven coins for a cow) but also another very important element, a third-party, somebody with skin in the game and someone that could engender a higher level of reliability in the system. Currency carries with it the authority of the issuer and even today an implied guarantee of value that, in the not too far distant past, was underwritten within the currency so that possessor of the currency would not be left in the lurch Undoubtedly the coins that were produced by the Rulers of these larger societies were guaranteed to be a reliable instrument of exchange, otherwise the community would have never have taken up acceptance of their use. One can easily imagine that the guarantee was something like, if all else failed, the ability to cash the coin in with the manufacturer (King Farookie) for a reliable standard exchange - say ten bags of grain. No doubt though, back then, as it is was up to almost current times, the only other risk to an individual involved in the coin market would be if the Kingdom was conquered and the King replaced by another authority, then the standard of exchange may vanish overnight. As I am reminded by the stories I heard when I was a young boy 1950's about the currency that the Japanese had printed in preparation for use in their conquered Asian countries - eventually including Australia. The third iteration of the currency barter system laid the basis for the period known as the gold standard. It was a way that countries protected the value of their currency in international trade by tying the amount of coinage distributed to thier held reserve of gold. One could determine the international value of the currency simply by dividing the amount of coinage in circulation into the value of the stated gold reserves held by the issuing authority. This system was also supported by what would colloquially be called, the buy back system, where you could present the currency to the issuing authority and exchange it for its value in gold bullion or some other agreed asset . But long gone are those days. So that is probably sufficient at this point to have an understanding of money. - - - If you need more go here Show me the money! But why is it important to understand money, in order to understanding how it functions within an ecconomy? Well an 'economy' is a nebulous thing. Economists have a definition of an economy akin to the definition that the 16th century cosmologists had for the solar system. In the extremely corralled definition of the economist's world, ‘economy’, is only certain objects of sufficient brightness that are able to be examined and they don’t go looking for the 'dark matter', 'gravitational wave' and the radiation hangover from the big bang - they just look at the bright, big and obvious objects - and that’s about it Economists talk about a concept called gross domestic product shortened down to those three infamous letters ‘GDP’. GDP is a monetary value ascribed to things that are produced within the ecconomy which are both easily measurable and more importantly, visibly produced. The GDP that economists know and love has more holes in it than a fishing net and just like a fishing net, a lot of material smaller than the mesh size passes right through and is never caught and also, as is the case with fishing nets, some large and powerful objects can bust right through and therefore not be captured by trawling, so never accounted for the at the end of the day, when the nets are lifted. But I’m sure in defence of the reliance upon the GDP position, economists would say it’s not perfect but it’s the best we’ve got. Though I hardly think that this excuse is as defensible as it was 20 years ago. But economists, lawyers and priests are all members of the sect produced by evolution that is vary resistant to change and extremely exposed to obsolescence in an environment undergoing rapid evolution. So where does the money come from? Well the answer is blindingly simple- ....... ALL MONEY COMES FROM ENERGY

Money as we have seen, is just the medium to facilitate exchange, a modern harbinger of life support.. The usefulness of money exchange system has gone through a number of iterations starting with Cowry shells and currently at Bitcoinalites. (cyber money). Sovereign nations produce currency which they distribute throughout their communities via their National banking system so that when money is produce from exploiting energy it can be convert to money readily in the form of coinage (currency) which is then readily tradable. While the system has evolved to be significantly advanced in its operation, without utilising the fruits of energy, the money system will cease to exist. So let’s look at some example of how we turn energy into money. The first requirement to turn energy into money is there needs to be a demand for the product (Goods or Services) as consequence of that energy expenditure. For example: iron and oxygen resulted from massive energy expenditure in stars tens of billions of years ago when the expenditure of energy drove nuclei injection, thus making a huge range of atoms. In the case of Iron which becomes stored within the crust of this planet (and everywhere else), combined with and oxygen to form iron ore - which can be converted to money, - if there is a need for iron ore. Imagine one of our old caveman mates, digging up a pot of iron ore 50,000 years ago in the Pilbara region of Australia would have buckleys of creating any money at all because, and I know I’m speculating, nobody at that stage wanted any iron ore. Fast forward 50,000 years and now the world is quite happy to pay in the vicinity of $200US, just for one tonne. This method of potential money production from the consequences of historic energy is what drives the mining (oils and minerals) ndustries. But historic energy is not the only source of money. The sun at the centre of our solar system provides us with about 430,000,000,000,000,000,000 joules of energy - per hour.. That is slightly more than the annual energy demand for the 7.5 billion humans of the planet. This energy produces the food we convert into huge amount of money (and I know you thought it was out of some philanthropic asperation to feed the masses- but alas no! - it is solely driven by the insatiable desire to make shit loads of money) as a consequence of this energy This method of making money from current solar energy is what drives our primary industries (agriculture, horticulture, forestry, animal husbandry and fishing to name but a few). But historic energy and solar energy are not the only sources of energy available to humans An adult human on average generates somewhere between 6,000 to 9,000 kilojoules of energy a day, thanks to the conversion of the energy value of our nutrition intake. Some of this bio energy (about15%) can be converted into money. And if you don’t believe me simply get a bucket and a sponge go to a carpark, offer to expend some of your surplus energy in washing someone’s car for the exchange of some dollars and before you know it you will have utilised the fundamental principle underpinning the generation of money.[Remembering however the first principal 'demand'] However, for the purposes of completeness it is neccessary to consider the acquisition of other's money without the expenditure of much energy. While not zero it certainly is a lot less energy than to initially generate/harvest it yourself. The one thing that economists are right about is that it is the economy that is the way that the money, (generated from energy), gets circulated. Just like in the old days when you could take a scoop net down to your friendly estuary and scoop up a pot of prawns as they swam by, so to if you develop a strategy, you can harvest some of that energy money, made by others as it swims by. This method of money harvesting of existing energy money is what drives the tourist, education, health, gambling and entertainment industries, to name but a few. In 2020 the world economy produced $81 trillion (US) of GDP. That is, $10,800 for every man, women and child on the planet.(192 million₫ [dong] if you live in Vietnam) And don’t forget the GDP figure is just what the net caught. It doesn't’t measure what passed through or was able to avoid being caught – altogether! How much of that cited GDP figure is ‘energy money’ and how much of it is ‘recycled currency’ and how much of that figure represents value that has been counted 2, 3, 4, 5 or 6 times, as it continues to loop through one system or another - we don’t know. We don’t bother to invest in the technology to be able to answer those questions. I do know that Facebook has over 1 billion accounts and thereby monitors the activity of 1 billion people but the major global powers such as China, United States, Germany, Japan, but to name a few, don’t seem to have the ability or inclination to do what Google and Facebook can do, harvest data on money movement in the large masses of society.

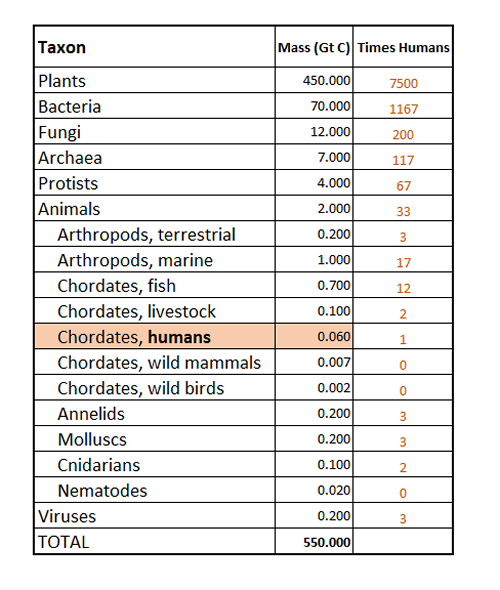

So! where to from here?Well, if we need to utilise the historic and or current expenditure of energy, in order to generate money, to fuel the human economies of the planet, to meet the demands for consumption of goods and services, by a ever increasing social expectations, of the ever increasing number of humans occupying the planet, expanding at an expotential rate, then what are the longer-term consequences for the harvesting of all this energy for the purposes of providing the money to pay for these luxuries of life that money can buy then we need to understand that humans are not the only biomass on the planet that needs the products of our energy. We can’t actually weigh all the biomass of the planet to work out how many tonnes this represents in order to know the energy requirements of living things but what some scientists have done is to calculate the amount (mass) of carbon there is within organic cells of a wide range of Taxa. If we accept that we currently cannot know the total biomass of the planet we can however do the next best thing and have a figure of the total amount of carbon within that biomass and then use that as a comparison for the purposes of calculating the relationship between humans use of energy for money creation and other taxa needs for energy for survival. Scientists tell us that currently the amount of carbon in the biomass of the planet is somewhere in the vicinity of 550 billion tonnes.and that biological activity on the planet is producing about 100 billion tonnes a year.

Here is the biomass relationship

As can be seen humans are about one 7500th of the biomas of plants. [Ref] Plants have a hugh resoivoir of stored energy and according to Cornell University researcher David Pimentel 'Approximately 50% of the world's biomass is used by humans {food; lumber; pulp; fuel; medicines; support for our animals and the microbes in the natural ecosystem, essential for our survival}' [Ref] So, we don’t know of course what of this 225Gt (50% of 550Gt) is directly consumed by humans without being purchased in order to generate their own personal energy needs and how much of it is converted into money. We do know however that in order to produce 6000 kilojoules of energy (The daily need for a average human) 3000g of a mixed diet (From lettuce to meat) of food needs to consumed. That’s just on 1 tonne of food per person per year. Apparently, there are about 140,000 farms in Australia producing both plant and meat food products. Suppose the average farm household is 4 persons, then 560,000 tonne of food needs to be grown to meet their own personal nutritional requirements - the rest tonnes is for money. In 2020 it is reported that Australia produced at least 55.6 million tonnes of food to support human life.(maybe as much as 70,000,000 mt[Ref]) In 2020, in Australia, that 55.5 million tonnes of food was converted into $80 billion(au) money, That 98.9% of the energy used to produce food that year was turned onto money. On a different issues, see how much tax the farmers paid on that income.

A work in progress - TO HERE

Hope you have found this useful and interesting so far!

Warren Bolton May 2021

|

|

To leave or abandon one without assistance in a particularly awkward, difficult, or troublesome situation. |